Learn to Rank Risky Investors: A Case Study of Predicting Retail Traders' Behaviour and Profitability

Abstract

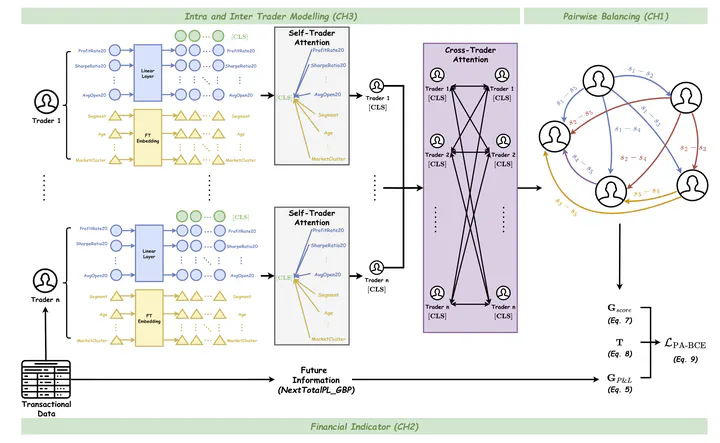

Identifying risky traders with high profits in financial markets is crucial for market makers, such as trading exchanges, to ensure effective risk management through real-time decisions on regulation compliance and hedging. However, capturing the complex and dynamic behaviours of individual traders poses significant challenges. Traditional classification and anomaly detection methods often establish a fixed risk boundary, failing to account for this complexity and dynamism. To tackle this issue, we propose a profit-aware risk ranker (PA-RiskRanker) that reframes the problem of identifying risky traders as a ranking task using Learning-to-Rank (LETOR) algorithms. Our approach features a Profit-Aware binary cross entropy (PA-BCE) loss function and a transformer-based ranker enhanced with a self-cross-trader attention pipeline. These components effectively integrate profit and loss (P&L) considerations into the training process while capturing intra- and inter-trader relationships. Our research critically examines the limitations of existing deep learning-based LETOR algorithms in trading risk management, which often overlook the importance of P&L in financial scenarios. By prioritising P&L, our method improves risky trader identification, achieving an 8.4% increase in F1 score compared to state-of-the-art (SOTA) ranking models like Rankformer. Additionally, it demonstrates a 10%-17% increase in average profit compared to all benchmark models.

Type

Publication

ACM Transactions on Information Systems, Volume 44, Issue 1

Citation

@article{10.1145/3768623,

author = {Li, Weixian Waylon and Ma, Tiejun},

title = {Learn to Rank Risky Investors: A Case Study of Predicting Retail Traders’ Behaviour and Profitability},

year = {2025},

publisher = {Association for Computing Machinery},

address = {New York, NY, USA},

issn = {1046-8188},

url = {https://doi.org/10.1145/3768623},

doi = {10.1145/3768623},

abstract = {Identifying risky traders with high profits in financial markets is crucial for market makers, such as trading exchanges, to ensure effective risk management through real-time decisions on regulation compliance and hedging. However, capturing the complex and dynamic behaviours of individual traders poses significant challenges. Traditional classification and anomaly detection methods often establish a fixed risk boundary, failing to account for this complexity and dynamism. To tackle this issue, we propose a profit-aware risk ranker (PA-RiskRanker) that reframes the problem of identifying risky traders as a ranking task using Learning-to-Rank (LETOR) algorithms. Our approach features a Profit-Aware binary cross entropy (PA-BCE) loss function and a transformer-based ranker enhanced with a self-cross-trader attention pipeline. These components effectively integrate profit and loss (P&L) considerations into the training process while capturing intra- and inter-trader relationships. Our research critically examines the limitations of existing deep learning-based LETOR algorithms in trading risk management, which often overlook the importance of P&L in financial scenarios. By prioritising P&L, our method improves risky trader identification, achieving an 8.4\% increase in F1 score compared to state-of-the-art (SOTA) ranking models like Rankformer. Additionally, it demonstrates a 10\%-17\% increase in average profit compared to all benchmark models.},

note = {Just Accepted},

journal = {ACM Trans. Inf. Syst.},

month = sep,

keywords = {learning to rank, domain-specific application, individual behaviour modelling, risk assessment}

}